A lacklustre Spring Budget with no direct help for first-time buyers or mortgage market innovations has slowed buyer demand although the number of sales being agreed is now 13% higher than this time last year, latest data from Rightmove reveals.

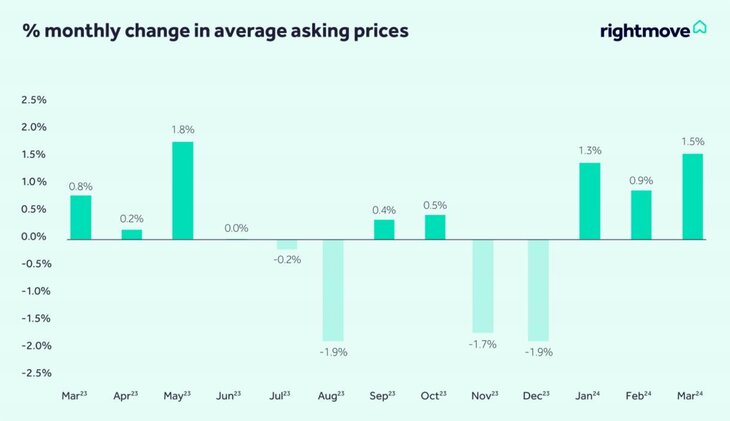

While demand may have eased it’s still 8% above last year and average asking prices have risen 1.5% (+£5,279) to £368,118 – higher than the historic average March increase of 1.0% and the biggest for 10 months.

But the average time to find a buyer is 71 days, the longest at this time of year since 2019 with over-optimistically priced sellers are taking longer to find a buyer.

Tim Bannister, Rightmove

Tim Bannister, Rightmove’s Director of Property Science, says: “The stronger than usual price growth this March indicates that new sellers are feeling much more confident.

“Despite the above average price increases in this opening three months of the year, asking prices are still £4,776 below their peak in May 2023.

For those who can afford to buy and have yet to take action to move this year, this may provide a window of opportunity to buy as we now seem to be past the bottom of the market.”

But he warns: “We know from last year how quickly the picture can change with some negative economic news or surprises.

“Buyer affordability remains stretched and higher mortgage rates are an ongoing challenge. With the market still sensitive to pricing and external events, some caution and willingness to negotiate is advised for sellers who are keen to find a buyer in the Spring market.”

INTERSTING TRENDS

Jeremy Leaf, north London estate agent and a former RICS residential chairman, says: “Although these are asking or aspirational prices, rather than selling prices of new listings, this data reflects some interesting market trends, which we’ve also seen on the ground.

Jeremy Leaf

“More listings mean buyers are often spoilt for choice, so are not rushing to take the plunge. Some were holding back from making offers in expectation of Budget giveaways or further mortgage rate cuts which have not really materialised.”

For months, people have taken a hit on their property prices.”

Nathan Emerson, Chief Executive of Propertymark, says: “Following three years of economic turmoil, Propertymark is hopeful that we are now witnessing a positive trend towards increased prosperity in the housing market.

Nathan Emerson, Propertymark

“For months, people have taken a hit on their property prices in order to find an affordable middle ground to enable a home move.

“Now that balance is being better struck and with interest rates remaining stable, we are seeing signs of normality and strong overall indicators now is an attractive time to buy or sell property.

“Our member agents have reported an 80% increase in the number of new properties available and a 129% increase in the number of market appraisals undertaken, showing there is growing appetite amongst buyers and sellers alike.”

AFFORDABILITY

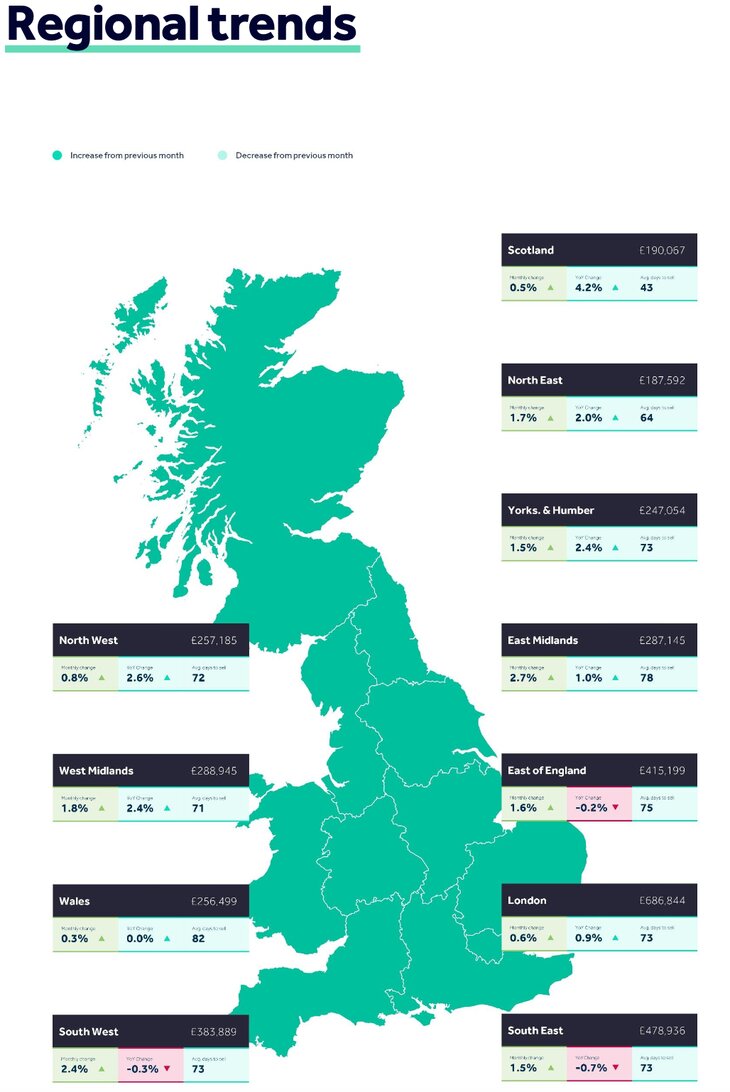

Marc von Grundherr, Director of Benham and Reeves, adds: “While mortgage affordability remains an issue, it certainly hasn’t dampened the appetite of London buyers and we’ve continued to see a high level of activity at all price thresholds, but particularly across the super-prime market.

Marc von Grundherr, Benham and Reeves

“Buyers at the very top end of the ladder are acting with great confidence, with the higher cost of borrowing not presenting the same obstacle as the average homeowner.

“As a result, we’re seeing high demand for super-prime stock and many more buyers circling due to a more constrained supply of suitable properties in this sector.”

Tomer Aboody, MT Finance

Tomer Aboody, Director of lender MT Finance, says: “Sellers appear much more confident than they have for some time, with more stock coming to market and stronger asking prices on the back of hopes that interest rates have peaked and will start coming down soon, as inflation continues to fall.

“The Budget was disappointing with a lack of incentives to boost the market and transactions. Perhaps the government is keeping its powder dry for later in the year and closer to a general election when it might take some action, such as reducing stamp duty.”

The Negotiator The essential site for residential agents

The Negotiator The essential site for residential agents

Please note: This is a site for professional discussion. Comments will carry your full name and company.