House price headlines

Rightmove

Better-than-predicted year, as sellers price more competitively.

“Average new seller asking prices drop by 1.7% (-£6,088) this month to £362,143, as Christmas approaches and sellers continue to adopt more pricing realism to attract a buyer.”

Home.co.uk

Stock levels and prices in seasonal decline.

“Asking prices across England and Wales dropped by 0.6% during October, making the year-on-year fall in asking prices just -1.6%.”

RICS

Sales market remains subdued albeit most indicators turn slightly less downbeat over the month.

“National house prices continue to fall, although the pace of decline appears to be levelling off.”

Nationwide

House price recovery continued in November.

“UK house prices rose by 0.2% in November, after taking account of seasonal effects. This was the third successive monthly increase and resulted in an improvement in the annual rate of house price growth from -3.3% in October, to -2.0%. While this remains weak, it is the strongest outturn for nine months.”

Better-than-predicted year, as sellers price more competitively.

Halifax

UK house prices rise for the second month in a row.

“Average house prices rose by +0.5% in November, following a rise of +1.2% in October. Property prices dropped by -1.0% on an annual basis (vs -3.1% last month).”

E.surv

November house prices continue to fall.

“Cash and mortgage data show average prices decline by an annual -4.6%.”

Zoopla

Price falls extend across country, but declines remain modest.

“UK house price inflation slows to -1.2%, down from 8.2% a year ago.”

Summary of key statistics

Rightmove

- Sales agreed are now 10% below 2019’s more normal market level, improving from 15% below last month.

- The pandemic-driven stock shortage is over, with available properties for sale now just 1% behind 2019.

- The number of sales being agreed for studio, one and two-bed properties is just 7% lower than 2019’s level, compared to four-bed detached houses and all five-bed plus properties, where agreed sales are 14% behind 2019.

Nationwide

- House prices down by 2% compared with last year.

- In mid-August, investors had expected the Bank of England to raise rates to a peak of around 6% and lower them only modestly (to c.4%) over the next five years. By the end of November, this had shifted to a view that rates have now peaked (at 5.25%) and that they will be lowered to around 3.5% in the years ahead.

- The number of mortgage approvals for house purchases has been running at c.30% below pre-pandemic levels.

- A rapid rebound still appears unlikely. Cost-of-living pressures are easing, with the rate of inflation now running below the rate of average wage growth, but consumer confidence remains weak, and surveyors continue to report subdued levels of new buyer enquiries.

Halifax

- Property prices dropped by -1.0% on an annual basis (vs -3.1% last month).

- South East England continues to see most downward pressure on house prices.

- The resilience seen in house prices during 2023 continues to be underpinned by a shortage of properties available, rather than any significant strengthening of buyer demand.

- The economic conditions remain uncertain, making it hard to assess the extent to which market activity will be maintained. Other pressures – like inflation, the broader cost of living, overall employment rates and affordability – mean we expect to see downward pressure on house prices into next year. Latest Bank of England figures show the number of mortgages approved to finance house purchases increased in October 2023, by 8.5% to 47,383. Year-onyear the October figure was 17.1% below October 2022. (Source: Bank of England, seasonally-adjusted figures)

Home.co.uk

- In line with seasonal expectations, the total sales stock count for England and Wales has dropped significantly since the October reading.

- The current total of unsold property is 468,220, around 5,000 lower than last month.

- The supply rate of new instructions entering the market is remarkably restrained overall: down 3% year-on-year and down 8% vs. October 2018. The largest increase at the regional level was observed in the North East (+7%), while the largest year-on-year fall in supply was in Greater London (-8%).

- The Typical Time on Market for unsold property in England and Wales increased by three days during October in line with seasonal expectations. The current median is 93 days; in pre-COVID October 2019, the same measure was 101 days.

- The mix-adjusted average asking price for England and Wales is currently down 1.5% since November 2022.

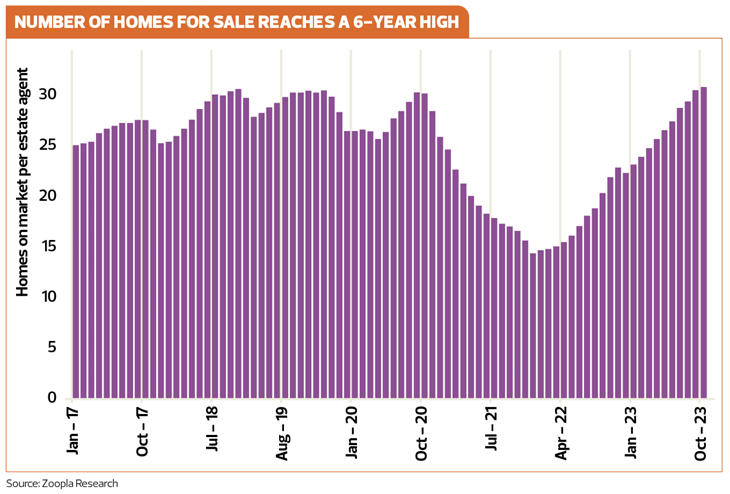

Zoopla

- UK house price inflation slows to -1.2%, down from 8.2% a year ago.

- Homes for sale touches a 6-year high boosting choice and reenforcing the buyer’s market and downward pressure on prices.

- Sellers accepting 5.5% off the asking price to agree sales, an average discount of £18,000 – the largest gap for over 5 years.

- Discounts to asking prices for agreed sales are 6.1% in London and the South East (£25,000) and 4.8% (or £11,000) for rest of UK.

- For 3 and 4+ bed houses supply has rebounded the most

- While there has been a modest rebound over the autumn, demand remains 13% lower than 2019. Demand is also 10% higher than last year when the fallout from the mini budget drove a rapid decline in buyer interest.

- New sales are still being agreed, tracking 15% higher than a year ago and 5% higher than 2019 levels.

- The larger price falls are concentrated across southern England, especially in markets that registered strong demand and fast price.

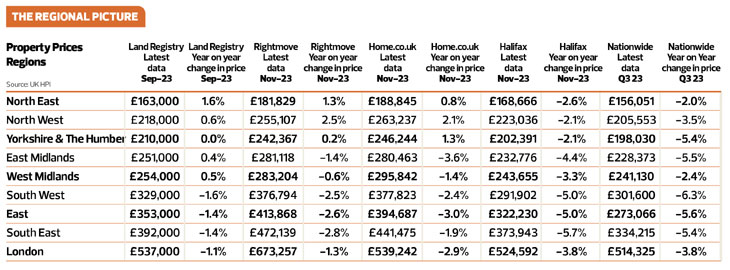

Regional house prices

Kate says: Currently, the price indices are reporting that either the East of England or the South East are the worst performing markets, followed by London.

Kate Faulkner

However, this sounds much worse than the ‘reality’ which is that we still aren’t seeing any of the ‘Armageddon’ price falls some predicted and prices are, a few percent to 6% down according to Nationwide and Halifax. They tend to see higher falls as they only monitor properties bought with a mortgage, rather than cash, so miss out on 30%+ of the market.

The reality is that prices have done extremely well since the pandemic and most home owners could have coped with 10% falls, so not only has the market some ability to fall more, but people can cope too. The bigger threat of course is mortgage rate rises, but even these seem to have peaked so far – as long as we don’t get any more shocks. What is being missed by much of the media though is that London has not performed as well as the rest of the market and there is little mention that currently, even though prices are high versus the rest of the country, prices are actually quite good value for money:

“While London house prices are high in absolute terms, they have failed to keep pace with the rest of the UK over the last six years. The average value of a London home is just 8% higher than seven years ago, in nominal terms, whereas UK house prices are 28% higher.”

Commentary on towns and cities

Kate says: Overall, out of 30 cities, since 2005, property prices have risen above the average 3.8% inflation in 11 cities/towns, including Leicester, Bristol and Edinburgh, remained the same as inflation in two cities/towns – Sheffield and Norwich, with price growth staying below inflation for the remaining towns and cities. What this shows is that in real terms, especially for those who own outright, their property isn’t necessarily delivering from an investment perspective.

Demand and supply

Kate says: Despite much of the media focusing on property prices, what’s more important is the data we receive on transactions. Typically, when demand falls and supply rises, this can have quite a dramatic impact on property prices. In the last two recessions, prices fell by around 20%, but, although we haven’t seen a full-blown recession this year, prices do seem to be divorcing from dramatic drops in demand. This is partly because supply has been so tight, but also because people have received better pay rises over the last few years than in the past, the tighter mortgage rules introduced in 2014 have helped to ensure people can not only afford to buy in a low mortgage rate market, but also in a more ‘normal rate’ market of around 5%.

As such, although we will never get rid of ‘boom and bust’ with property prices, they certainly seem to be rising less in the good times and falling less in the bad times.

There is no doubt though that with one million sales this year and the same forecast for 2024, transactions have hit the industry harder than affordability issues have hit buyers and sellers. What this means though is the industry needs to be super careful at which properties they agree to sell – and from which sellers. Those who aren’t being realistic on price and those who don’t help and support the agent to collate the new material information required are going to cost rather than make agents money. Although some may worry about the impact of refusing properties, it may actually help boost business over time as telling someone ‘no’ can be quite powerful, and in our market, will help you stand out.

HMRC

“Provisional figures for October 2023 show a fall in residential transactions, continuing the decrease observed in September. Seasonally adjusted transactions fell by 3% in October 2023 relative to September 2023 and non-seasonally adjusted figures are down 17% relative to October 2022 and down by 2% compared to September 2023.”

Propertymark

“The number of new homes placed for sale per member branch has decreased again this month with nine properties available on average per branch in October 2023, compared with 11 in September and 13 in August. We would expect this trend to continue as we enter the festive season, and the market begins to cool. The number of sales agreed HMRC “Provisional figures for October 2023 show a fall in residential transactions, continuing the decrease observed in September. Seasonally adjusted transactions fell by 3% in October 2023 relative to September 2023 and non-seasonally adjusted figures are down 17% relative to October 2022 and down by 2% compared to September 2023.” Propertymark “The number of new homes placed for sale per member branch has decreased again this month with nine properties available on average per branch in October 2023, compared with 11 in September and 13 in August. We would expect this trend to continue as we enter the festive season, and the market begins to cool. The number of sales agreed per member branch has decreased to seven in October 2023 from eight in September, but sits firmly in the range (6-8) that has been prevalent over the last 10 months. Given the emergence of seasonal trends, it is not surprising that the average stock of properties available for sale per member branch decreased from 45 in August to 39 in September and laterally 37 in October 2023.”

Data from Chris Watkin and TwentyEA

Kate says: This data is becoming absolutely essential for any analyst and everyone working in the market that has to forecast their revenue and transactions moving forward.

As you can see from the latest charts, listings are back up to where they were to pre-pandemic levels, and we know from the analysis to date that new listings are helping to drive down prices, taking the ‘froth’ off the market from 2022.

This in turn is helping to boost sales and I for one think this is probably the best time to buy. Partly because November/December are times when people do drop out of the market, so demand is limited, but also because we’ll likely get a bit of bounce in sales by March/ April time next year with the extra stock attracting previously unsure buyers – along with hopefully some more competitive mortgage deals.

Great to see more deals being done too. Although not quite back to pre-pandemic levels, I am getting reports of a flurry of activity from people who were sitting on the fence purchase wise, but have now decided to take the plunge prior to Xmas.

Clearly year on year analysis is pretty useless based on the fact that this time last year we were all suffering from the fall out of the disastrous Liz Truss government.

Zoopla – Record high supply of homes for sale

“A chronic scarcity of homes for sale over the pandemic, particularly for 3+ bed family houses, was a key driver of high house price inflation. This position has fully reversed with the highest number of homes for sale per estate agent for six years.

“The rebound in supply has been recorded in the market for 3 and 4+ bed family homes, a trend across all parts of the UK. Only in Scotland, the North-East and North-West are levels of supply still below their pre pandemic levels.

“The average estate agency branch has 31 homes for sale, compared to a low of just 14 in the middle of the pandemic boom. This is boosting choice amongst would-be buyers and providing them with much greater negotiating power with sellers as they agree pricing.”

Largest discounts to asking price for over 5 years

“The strength of the buyer’s market is evidenced by the fact that the discount to asking price for achieved sales is now at a 5-year high. This also signals evidence of greater realism amongst sellers.

“During the pandemic years buyers had to pay the asking price to secure a property. Over the course of 2023 the gap has widened and sellers have been accepting ever larger. In the first six months of 2023 discounts to the asking price averaged 3.4%. This has now grown to 5.5% for sales over the first half of November – a median discount of £18,000 off the asking price. This is larger than the previous high recorded in 2018, the last time housing demand weakened, and prices came under downward pressure.”

Where is the market going?

Kate says: It’s been a much better year this year than many people predicted. Zoopla wins the prize with their forecasts of 5% price falls and transactions at just over 1mn – although we are likely to come in at 1mn, which is 17% down on the average 1.2mn sales.

However, this shouldn’t be a surprise to anyone as the huge sales of nearly 1.6mn in 2021 and 1.3mn in 2022, plus the issues this year with mortgage rates and the cost of living crisis, it had to hit at some point. And this shouldn’t be causing any issues for the industry as money should have been put by in the ‘good years’ to get through the inevitable slow years. The good businesses in the industry I speak to have all had a bit put aside.

2024 will be as tricky to predict as this one though. There is hope that prices will bounce along the bottom, or fall slightly, but it will be very specific to that property and how keen the seller is to sell and how well the agents do at managing expectations and avoiding the temptation to take on properties at too higher price – especially with the data from Rightmove at The Negotiator Conference showing how damaging overpricing is for both agent and seller.

Transactions

Numbers are likely to be the same as this year and will continue at that rate until we see bank base rates and mortgage rates fall back, hopefully to around 4 to 5%.

What does this mean for the industry and buyers and sellers? Cash will continue to be king for buyers along with sellers that appreciate they need to price keenly to secure offers. For the industry, it will mean taking time to secure as many buyers as they can and then chasing the instructions that they already have demand for. To attract buyers will mean adjusting content to help show them that property is good value and still affordable.

Zoopla

“The current repricing of housing has further to run in 2024. It’s a positive that the number of new sales agreed is holding up, evidence that there are willing buyers and willing sellers ready to agree sales albeit at bigger discounts to asking price. We expect the number of homes for sale to start declining as some sellers take their property off the market with a view to relaunching in the new year. Homeowners that are serious about selling in H1 2024 need to set their asking price realistically to attract demand and agree a sale, especially in light of increased supply.

“Markets expect the Bank of England to start cutting rates around the summer of 2024. If mortgage rates start to fall further, this will support an improvement in demand and sales volumes later in 2024 but prices will remain under modest downward pressure.”

The Negotiator The essential site for residential agents

The Negotiator The essential site for residential agents

Please note: This is a site for professional discussion. Comments will carry your full name and company.