To see a clearer picture of where this generation chooses to live, work and play, CBRE conducted one of an extensive and detailed global study of millennials. This Global Major Report – Live Work Play: Millennials Myths and Realities is, says CBRE, believed to be one of the most extensive and detailed global studies of how and where the millennial generation chooses to live, work and play, with major implications for the future of real estate.

THE MILLENNIAL GENERATION

As one of the largest generations in history, millennials are reshaping the global economy and influencing the built environment along the way.

As one of the largest generations in history, millennials are reshaping the global economy and influencing the built environment along the way.

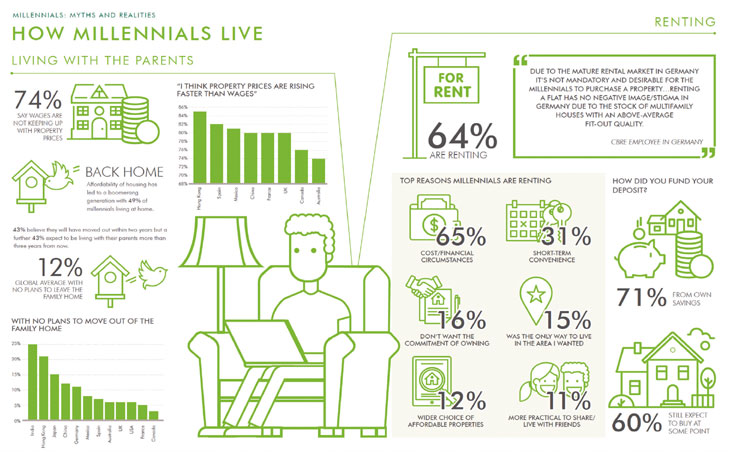

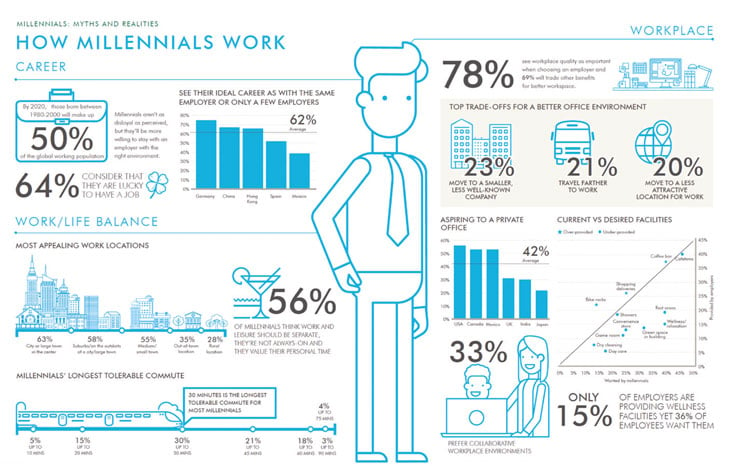

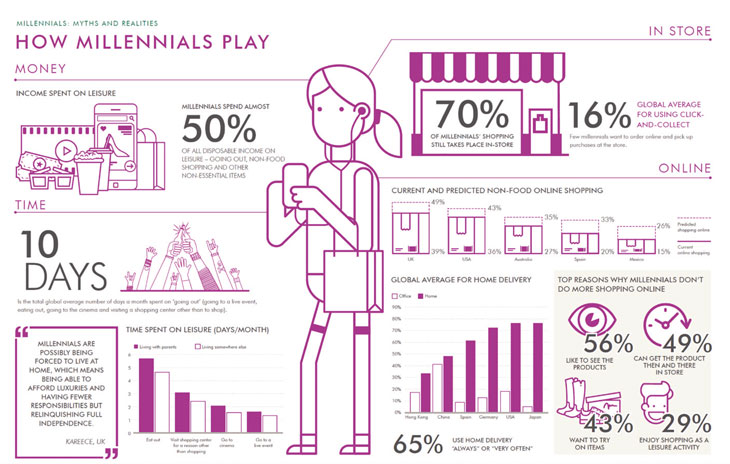

They are more connected, tech-savvy, educated and culturally diverse than any generation that’s come before them. Yet, at the same time, they face unique challenges. Many are debt-laden due to the 2008 recession. Others have delayed traditional lifestages into adulthood. They are also known as the Boomerang Generation, because, as many parents will confirm, they just keep coming back home to live. However, the survey also shows that they spend almost half their disposable income on leisure, so saving for a home of their own doesn’t appear to be a priority. They love eating out and they are keen shoppers.

As millennials enter their peak years there is a need for occupiers, investors and owners of real estate to better understand this generation.

As millennials enter their peak years, there is an opportunity – in fact, a need – for occupiers, investors and owners of real estate to better understand this generation and its strategic implications on real estate.

THE SURVEY

CBRE gathered 13,000 responses from millennials aged 22-29. There were 1000 respondents in each of 12 countries, representing the three major global regions, plus what CBRE describes as ‘an additional 6893 ‘internal responses from a range of ages to the same survey.’ They also held a series of internal discussion groups to extract more detailed findings.

THE FINDINGS

CBRE research found that a surprising 41 per cent of millennials in the UK still live with their parents. Of those, some 49 per cent intend to leave the family home within the next two years, but the majority are expecting to move into rented accommodation.

Lifestyle and socio-economic factors play a part, but it appears that the lack of affordability in the housing market, combined with tougher mortgage requirements, is significantly delaying millennials from moving out of the family home and purchasing their own property.

75% of UK millennial renters cite affordability as their main reason for staying in rented homes, compared with 63% in France and 56% in Spain.

In the UK, 75 per cent of millennial renters cite affordability as their main reason for staying in rented accommodation, compared with 63 per cent of millennials in France and 56 per cent in Spain.

There also seems to be an element of choice behind the decision to rent: 18 per cent of UK millennials prefer the convenience of renting and 72 per cent of respondents agree that purchasing a property would involve some lifestyle sacrifices.

CBRE’s research indicates the private rented sector will have an increasingly important role in providing homes for the future.

According to external forecasts, the number of households in the private rented sector will grow by 33 per cent by 2025. Developers and investors have already begun to respond to this by increasing the build-to-rent (BTR) markets in some of the UK’s most populated cities, with a rise in investment interest, in particular, from international institutions.

Although initiatives such as Help to Buy continue to encourage and support first-time buyers, the government has recently signalled a shift in policy away from a focus on home ownership for young people. Last September, the housing minister indicated that affordable rental homes may now be included in targets for starter homes.

Living standards and expectations in the private rented sector are rising, too. With more millennials moving out of state-of-the-art student accommodation (a sector undergoing a major transformation), there is greater demand for high-quality new-build homes, offering flexible and convenient living with social areas and on-site amenities.

Developers, build-to-rent providers and policymakers who respond to a changing market will be the most effective – in providing solutions for young people. Mark Collins, CBRE.

Mark Collins

Mark Collins, Chairman of UK Residential at CBRE says, “Many BTR developers are responding to millennial demand by adopting student-style living in projects, incorporating large communal and dining areas and facilities such as gyms and libraries, and offering all-inclusive rental rates.

“In London, The Collective Old Oak is a fantastic example of a co-living space that brings together a collection of individuals looking to create their own community in a flexible and hassle-free way.

Those developers, build-to-rent providers and policymakers who respond to the changing market will be the most successful – and the most effective – in providing lasting housing solutions for young people.”

The Negotiator The essential site for residential agents

The Negotiator The essential site for residential agents

Please note: This is a site for professional discussion. Comments will carry your full name and company.